ESIC Online Payment: The ESI Scheme’s information and services portals are tailored to provide employers and employees with seamless and convenient services. This initiative encompasses the streamlined processing of online payments and ensures compliance for all involved parties. Employers can make monthly contributions through the platform, and those with SBI accounts and net banking access can make online payments efficiently. Explore further to delve into detailed information about the ESIC Online Payment process.

ESIC Online Payment 2023: Streamlining Contributions

ESIC, or the Employee’s State Insurance Corporation, now allows its members to make hassle-free online challan payments. As the overseeing body for employee’s State Insurance, ESIC plays a crucial role in providing social security and health insurance for Indian workers. To complete the ESIC Registration form in challan format, both employers and employees need to adhere to the necessary procedures. Employers contribute 4.75% of the worker’s earnings, while workers contribute 1.75%. Workers earning less than ₹137 daily are exempt from contributing to ESIC. For added convenience, individuals with net banking access can opt for online payments, eliminating the need to physically visit government offices and saving valuable time. ESIC online payments are due on the 15th of each month for beneficiaries.

Unveiling ESIC Online Payment: Key Highlights and Insights

| Scheme Name | ESIC Online Payment |

|---|---|

| Initiated By | Government of India |

| Beneficiary | Indian Citizens |

| Objective | To offer a convenient online challan payment option for ESIC contributions |

| Payment Mode | Online |

| Official Website | https://www.esic.gov.in/ |

| Key Features | – Facilitates hassle-free online payments for ESIC contributions. |

| – Ensures a user-friendly platform for Indian citizens. | |

| – Streamlines the process of contributing to ESIC through an online mode. | |

| – Enhances accessibility and convenience for beneficiaries. | |

| – Supports the government’s initiative towards digitalization and efficiency. |

ESIC Payment Online: Unraveling the Core Objective

The primary aim of the ESIC online payment system is to empower individuals to settle their challan payments seamlessly, eliminating the need to physically visit government offices. This initiative is designed to enhance system accessibility, saving valuable time and effort for the users. Access to net banking services is a prerequisite for making online payments, ensuring a convenient and efficient process. This initiative underscores the mandatory contributions to the Employee’s State Insurance Corporation, making it convenient for both employers and employees to fulfill their obligations from the comfort of their homes.

ESIC Payment Online: Exploring Features & Benefits

- Seamless Online Challan Payments:

- Members can conveniently make ESIC challan payments online.

- Comprehensive Health Insurance and Social Security:

- ESIC oversees a robust health insurance and social security program for Indian workers.

- Contributions Breakdown:

- Employers contribute 4.75%, and employees contribute 1.75% of earnings owed.

- Exemption for Low Daily Income:

- Employees with a daily pay less than ₹137 are exempt from ESIC contributions.

- Online Payment Convenience for SBI Account Holders:

- SBI account holders with net banking access can make ESIC payments online.

- Elimination of Government Office Visits:

- Online platform removes the need for physical visits to government offices.

- Streamlined Process and Time Savings:

- Online payments streamline the process, saving time and effort.

- Enhanced System Transparency:

- The online system improves transparency in the ESIC payment process.

- Mandatory Online Payments:

- Both companies and employees are mandated to make ESIC payments online.

These features and benefits collectively contribute to the efficiency, accessibility, and transparency of the ESIC Online Payment system.

Initiating ESIC Portal Registration: Step-by-Step Guide

Steps to Register on ESIC Portal:

- Visit the official ESIC website at https://www.esic.gov.in/.

- On the homepage, locate and click on the “Employer Login” option.

- The login page will appear on the screen.

- Choose the “Sign-up” option to initiate the registration process.

- The registration form will be displayed on the screen.

- Enter all the necessary details as prompted in the form.

- Click the submit button to conclude the registration process successfully.

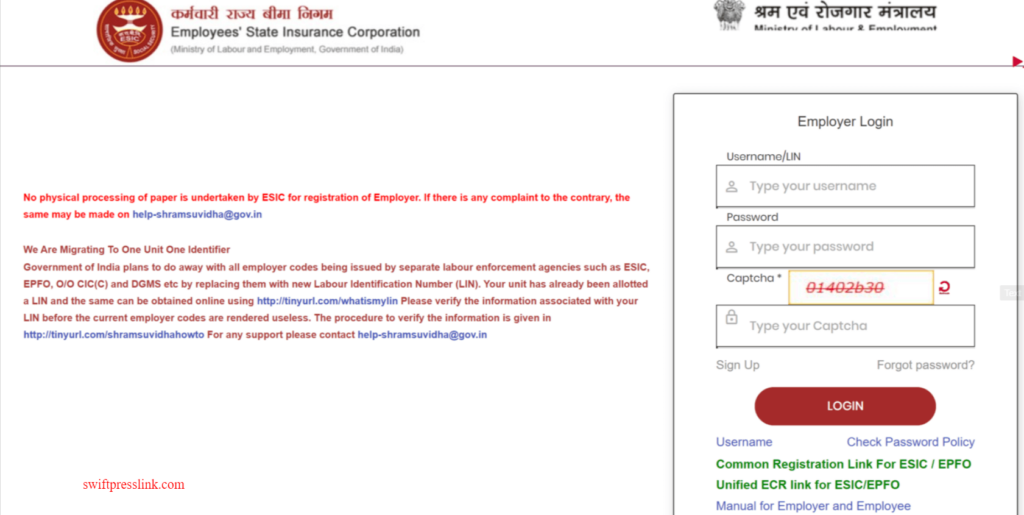

Accessing ESIC Portal: Stepwise Guide to Login

Steps to Login on the ESIC Portal:

- Visit the official ESIC website at https://www.esic.gov.in/.

- On the homepage, find and click on the “Employer Login” option.

- The login page will appear on the screen.

- Enter your user name, password, and the captcha code in the designated fields.

- Click the login button to access your registered account successfully.

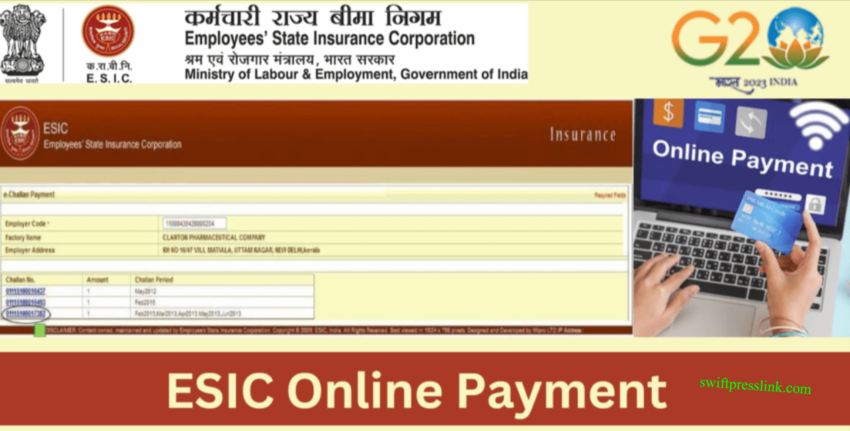

Initiating ESIC Online Payment: Step-by-Step Guide

Steps for Making ESIC Online Payment:

- Visit the official ESIC website at https://www.esic.gov.in/.

- On the homepage, find and click on the “Employer Login” option.

- Enter your user name, password, and the captcha code on the login page.

- Click the login button to access your registered account.

- The dashboard of your account will be displayed.

- Click on the Challan Number corresponding to the payment you want to make.

- Note down the challan number for future reference.

- Click on the “Continue” button.

- Under the Net Banking option, choose “State Bank of India” or select “Other Bank’s” option for alternative payment modes.

- Enter your bank’s online banking system using your login credentials.

- Verify the recipient’s information and the payment amount.

- If everything is correct, proceed with the payment.

- Save the receipt for your records once the payment is successfully made.

Filing Monthly Contributions: Step-by-Step Guide

Steps to File Monthly Contributions:

- Visit the official ESIC website at https://www.esic.gov.in/.

- On the homepage, access the Online Monthly Contribution Screen.

- Enter the necessary information for your contributions.

- A new page will open, allowing you to preview the contribution details.

- Click “Submit” to finalize the monthly contribution details with ESIC.

- For managing larger datasets, consider attaching an Excel file for bulk upload or manually entering details for each employee.

- After submission, click “Pay online” to initiate the online payment process using SBI net banking.

- Confirm the process by clicking “OK.”

- Note down the Challan number for future reference.

- Click “Continue” to proceed with the payment, redirecting you to the SBI online payment page.

- You will be directed to the banking website to complete the online payment through net banking.

- Enter your net banking login information to finalize the transaction.

- Upon successful payment, a confirmation page will be displayed.

Seamless ESIC Online Challan: Stepwise Instructions

Steps to Generate an Online Challan:

- Visit the official ESIC website at https://www.esic.gov.in/.

- On the homepage, locate and click on the “Generate Challan” link.

- A new page will open, presenting the Challan generation options.

- Click on the “View” option to proceed.

- Enter the required payment amount and select the record against which the payment is to be made.

- Choose the “Online Option” for electronic payment.

- Click the “Submit” button to initiate the Challan generation process.

- A notification confirming the submission of the request will be displayed.

- Finally, click on the “OK” button to complete the Challan generation process.